This article is going to outline all of the options for financial assistance options for businesses & contractors affected by COVID-19. We are going to cover the PPP (Paycheck Protection Program Loan, EIDL (Economic Impact Disaster Loan), and the EIDL Emergency Advance.

Please note that this program is constantly evolving and the information in this article is updated as quickly as we can but may not be the most up to date at all times. Always check with your bank about potential loans and their particular terms. This is not meant to substitute legal or financial advice.

Stay Updated on COVID-19 FINANCIAL ASSISTANCE OPTIONS

If you want to know when this blog post is updated with new information and want to know when I host free Q&A webinars over this information please put your information in the form below and I’ll be in touch.

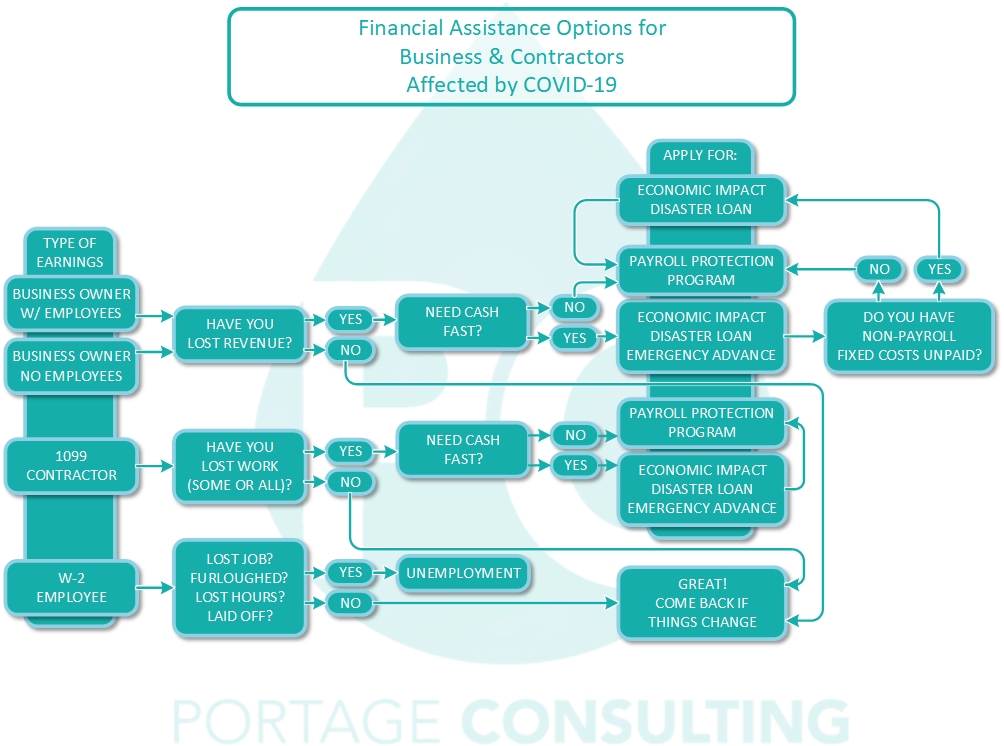

Financial Assistance Options Flowchart

This is a very long blog post so I’ve made this flow chart to help you determine what kind of assistance you would potentially be best based on your type of earnings and how COVID-19 has affected your business. Once you go through the flow chart, you can use the rest of the blog post to learn more about your particular options.

Click here to download flow chart.

PPP (Paycheck Protection Program) Loan

The Paycheck Protection Program Loan is aimed at business owners and Independent contractors with the main goal of keeping people (or yourself, independent contractors) on the payroll but can also be used for paying rent, utilities, and mortgage interest.

What can the PPP (Paycheck Protection Program) Loan be used for?

Business owners can use the PPP (Paycheck Protection Program) Loan for payroll, rent, utilities, mortgage interest and other necessary costs associated with running your business.

For independent contractors, you can use the PPP (Paycheck Protection Program) Loan for your normal living expenses as it essentially replaces your lost income.

Who is Eligible for the PPP (Paycheck Protection Program) Loan

Businesses with less than 500 employees who wish to continue paying their employees/rent/utilities/etc. Independent contractors are also eligible for the PPP (Paycheck Protection Program) Loan.

Does the PPP (Paycheck Protection Program) Loan need to be paid back?

The PPP (Paycheck Protection Program) Loan can be forgiven up to 100% if you are using it to keep your employees (or you, for independent contractors) on the payroll.

The percentage of Paycheck Protection Program Loan forgiveness is related to the percentage of staff you keep on your payroll. So, if you keep 75% of your staff on payroll, you will have 75% loan forgiveness which means you only have to pack back 25% of the Paycheck Protection Program Loan.

For paying this back, it’s 2 years at 1% Interest with a 6-month deferral.

How much money can you get through the PPP (Paycheck Protection Program) Loan

For business owners with employees, you are eligible for your 2019 average monthly payroll x 2.5

For independent contractors, you are eligible for your 2019 average monthly earnings x 2.5

What do you need to Apply for the PPP (Paycheck Protection Program) Loan?

For business owners, you will need

- 2019 Quarterly 941s

- Annual 940

- Paycheck Register for all of 2019

- Proof of Health Insurance paid on behalf of Employees (Bill from Health Insurance Provider)

- Retirement benefits paid by the company

- State and Local taxes paid by the company (NOT including state withholdings)

- This would include:

- State Unemployment Insurance

- Any Local or State Specific Taxes

- This is highly location-dependent and whoever runs your payroll will be able to tell you this.

- This would include:

For independent contractors

- 1099’s from 2019

- If ALL of your income was on 1099’s, that’s all you need. Otherwise…

- 2019 P&L (Profit & Loss statement) AND proof of income (more guidance to come on this soon)

Where to Apply for the PPP (Paycheck Protection Program) Loan?

Apply with your bank if they are an approved SBA lender. If your bank is not an approved SBA lender, find a bank that is and that is willing to take your application. There is a list of approved lenders on the SBA website: https://www.sba.gov/partners/lenders/microloan-program/list-lenders

Claiming the PPP (Paycheck Protection Program) Loan as income on your taxes

You do not have to claim the PPP (Paycheck Protection Program) Loan as income on your taxes.

Can I apply for the PPP (Paycheck Protection Program) Loan in addition to other loans/grants?

Yes. You can apply for the PPP (Paycheck Protection Program) Loan in addition to other loans/grants.

Pros of the PPP (Paycheck Protection Program) Loan?

- Can be forgiven

- Helps keep people on your payroll.

- Portion not forgiven has payments deferred for 6 months and has a low-interest rate

- No personal guarantee is required

Cons of the PPP (Paycheck Protection Program) Loan?

- The portion that isn’t forgiven must be repaid at terms of 2 years and 1% interest

- Has more strict rules on use of the funds (payroll, mortgage interest, rent, utilities; but only 25% of the forgiven amount can be for non-payroll items)

- We don’t know how long it will take for the bank to process the PPP (Paycheck Protection Program) Loan.

- Getting accepted for the PPP (Paycheck Protection Program) Loan depends a lot on your/your bank’s interpretation of the law as the SBA isn’t underwriting these loans. They’ll do their due diligence on the back end and most banks are only processing loans for existing customers.

Who is the PPP (Paycheck Protection Program) Loan best for?

The PPP (Paycheck Protection Program) Loan is best for business owners with fewer than 500 employees and independent contractors/sole proprietors (essentially everybody who is/was not a W2 employee).

EIDL (Economic Impact Disaster Loan)

The EIDL (Economic Impact Disaster Loan) is designed to cover costs above and beyond what the PPP covers with reasonable repayment terms.

What can the EIDL (Economic Impact Disaster Loan) be used for?

The EIDL (Economic Impact Disaster Loan) can be used to pay for any operating expenses (Payroll, rent, paying vendors, utilities, other loan obligations, accounts payable, etc.)

Who is eligible for the EIDL (Economic Impact Disaster Loan)

- Any small business

- As per SBA Guidelines

- Under 500 Employees

- Franchises that are listed as an approved SBA Franchise

- As per SBA Guidelines

- Independent Contractors

- If you get a 1099

- Gym Trainers

- Freelancers

- Non-Profits

Does the EIDL (Economic Impact Disaster Loan) have to be paid back?

The EIDL (Economic Impact Disaster Loan) does, indeed, need to be paid back. The terms are currently up to 30 years @ 3.75% interest. We currently believe the terms will be based on losses and the amount of the loan but this has not been announced yet.

How much money is available through the EIDL (Economic Impact Disaster Loan)?

You can potentially receive up to $2 Million through the EIDL (Economic Impact Disaster Loan) but we don’t know how much you’ll ACTUALLY be eligible for at this time. The SBA has not released their formula for distribution nor do you get to request a specific amount but we do believe it’s based on your Gross sales and Cost of goods sold (from the last 12 months)

What do I need in order to apply for the EIDL (Economic Impact Disaster Loan)?

To apply for the EIDL (Economic Impact Disaster Loan) you’ll need:

- Gross sales

- Cost of goods sold

- EIN

- Number of Employees

- General business and personal info.

Where do I apply for the EIDL (Economic Impact Disaster Loan)?

You apply for the EIDL (Economic Impact Disaster Loan) on the SBA website: https://covid19relief.sba.gov

Do I need to claim the EIDL (Economic Impact Disaster Loan) as Income on my Taxes?

You do not need to claim the EIDL (Economic Impact Disaster Loan) as income on your taxes.

Can I apply for the EIDL (Economic Impact Disaster Loan) in addition to other loans/grants?

You can, indeed, apply for the EIDL (Economic Impact Disaster Loan) in addition to other loans/grants.

What are the main pros with the EIDL (Economic Impact Disaster Loan)?

- There are higher loan amounts available through the EIDL (Economic Impact Disaster Loan) than other options

- Funds can be used wherever needed

- Terms can be up to 30 years at 3.75% Interest

What are the cons to the EIDL (Economic Impact Disaster Loan)?

- The main cons of the EIDL (Economic Impact Disaster Loan) is that it requires a personal guarantee (which means they’ll pull your credit)

- The EIDL (Economic Impact Disaster Loan) must be repaid in full and has no forgiveness potential

- Processing time for the EIDL (Economic Impact Disaster Loan) is currently unknown as applications have been submitted for over a week now and thus far not a single dollar has been disbursed.

Who is the EIDL (Economic Impact Disaster Loan) best for?

The EIDL (Economic Impact Disaster Loan) is best for businesses that have fixed costs and overhead above and beyond what the PPP will cover.

Who is the EIDL (Economic Impact Disaster Loan) NOT good for?

Independent contractors with little/no overhead and fixed costs. If you are an Independent contractor with lost business and are now struggling with PERSONAL finances (rent, groceries, car payments, etc) the PPP (Paycheck Protection Program) Loan is specifically made for covering these hardships.

The EIDL (Economic Impact Disaster Loan) may not be ideal for business owners with poor personal credit.

EIDL (Economic Impact Disaster Loan) Emergency Advance

The EIDL (Economic Impact Disaster Loan) Emergency Advance is designed to be a quick way to get near-immediate financial support.

What can the EIDL (Economic Impact Disaster Loan) Emergency Advance be used for?

The EIDL (Economic Impact Disaster Loan) Emergency Advance can be used for any operating expenses (payroll, rent, paying vendors, outstanding debt obligations, accounts payable, etc.)

Who is eligible for the EIDL (Economic Impact Disaster Loan) Emergency Advance

- Any small business

- As per SBA Guidelines

- Under 500 Employees

- Franchises that are listed as an approved SBA Franchise

- Independent Contractors (1099 Contractors, freelancers, etc)

- Non-Profits

Does the EIDL (Economic Impact Disaster Loan) Emergency Advance have to be paid back?

The EIDL (Economic Impact Disaster Loan) Emergency Advance does NOT have to be paid back. This is an emergency grant.

If you are a business owner and you apply for the both the EIDL (Economic Impact Disaster Loan) Emergency Advance AND the PPP (Payroll Protection Loan), the Emergency Advance will be added to your PPP.

For Example: If you apply for the EIDL Emergency Advance and get approved for $10,000 AND you get approved for $50,000 through the PPP, you will essentially now have $60,000 that must be paid back at the same forgiveness percentage as listed for the PPP above.

So, If you get $50,000 from the PPP and $10,000 from the EIDL Emergency Advance in order to keep 75% of your staff on payroll, you will only be required to pay back 25% of $60,000 (PPP & EIDL Emergency Advance combined) at the terms defined by the bank through the PPP.

If you are an independent contractor and you apply for the both the EIDL (Economic Impact Disaster Loan) Emergency Advance AND the PPP (Payroll Protection Loan), the Emergency Advance will be added to your PPP.

For Example: Let’s say your average monthly earnings as an independent contractor is $5,000, under the PPP, you got 12,500 (2.5 x your monthly earnings) but you ALSO were granted an Emergency Advance of, say, $3,000.

The total you’ve brought in from the PPP and the Emergency Advance is $15,500 which is $5,500 MORE than you would have brought in under a normal 8 week period (Since the PPP is designed to get you through two months) you would be responsible for repayment of the $5,500 excess at the terms defined by the bank through the PPP.

How much money is available through the EIDL (Economic Impact Disaster Loan) Emergency Advance?

Up to $10,000 is available through the EIDL (Economic Impact Disaster Loan) Emergency Advance but nobody knows at this time how much you will ACTUALLY receive. So if you need it, just apply for it and you get what you get (and don’t throw a fit).

What do I need in order to apply for the EIDL (Economic Impact Disaster Loan) Emergency Advance?

- Gross sales

- Cost of goods sold

- EIN

- Number of Employees

- General business and personal info.

Where do I apply for the EIDL (Economic Impact Disaster Loan) Emergency Advance?

When you are applying for the EIDL (Economic Impact Disaster Loan) there is a checkbox at the bottom of the form you simply check to apply for the Emergency Advance: https://covid19relief.sba.gov

The only way to apply for this Emergency Advance is to apply for the EIDL (Economic Impact Disaster Loan).

Do I need to claim the EIDL (Economic Impact Disaster Loan) Emergency Advance as Income on my Taxes?

You do not need to claim the EIDL (Economic Impact Disaster Loan) Emergency Advance as income on your taxes.

Can I apply for the EIDL (Economic Impact Disaster Loan) Emergency Advance in addition to other loans/grants?

You MUST apply for the EIDL (Economic Impact Disaster Loan) in order to apply for the EIDL (Economic Impact Disaster Loan) Emergency Advance.

This Emergency advance does not restrict the other types of loans you can apply for.

If you get the EIDL (Economic Impact Disaster Loan) Emergency Advance AND the PPP, the Emergency Advance will be added to your PPP for repayment terms as discussed above.

What are the main pros with the EIDL (Economic Impact Disaster Loan) Emergency Advance?

It’s SUPPOSED to be fast. The SBA initially said it would be available in 72 hours but have since changed this to “You’ll get it once your application has been reviewed”.

What are the cons to the EIDL (Economic Impact Disaster Loan) Emergency Advance?

To our knowledge, there are no negatives to applying for the EIDL (Economic Impact Disaster Loan) Emergency Advance.

Who is the EIDL (Economic Impact Disaster Loan) Emergency Advance best for?

The EIDL (Economic Impact Disaster Loan) Emergency Advance is good for anyone who needs cash quickly for any operating expenses (Payroll, rent, paying vendors, paying accounts payable)

Grants from private foundations & local governments

There are numerous grants from private foundations and local governments available. The best way to find these grants will be to reach out to your local chamber of commerce.

Unemployment Options

Unemployment is not really part of any of these loans but can be used in conjunction with them under certain circumstances.

Who is eligible for unemployment?

- 1099 Independent contractors who have lost work/revenue (some or all of it)

- W-2 Employees who had their hours cut and are now working part-time

- W-2 Employees who have been laid off

- W-2 Employees who have been furloughed (meaning they’ll get their jobs back when the business opens again)

You won’t be able to double-dip with PPP or the EIDL Emergency advance with this. If you are receiving unemployment benefits and accept either of these other options, you need to talk to your unemployment agency to find your options.